tax loss harvesting example

Stock for less than. Down Markets Offer Big Opportunities.

Tax Loss Harvesting Capital Loss Deduction Td Ameritrade

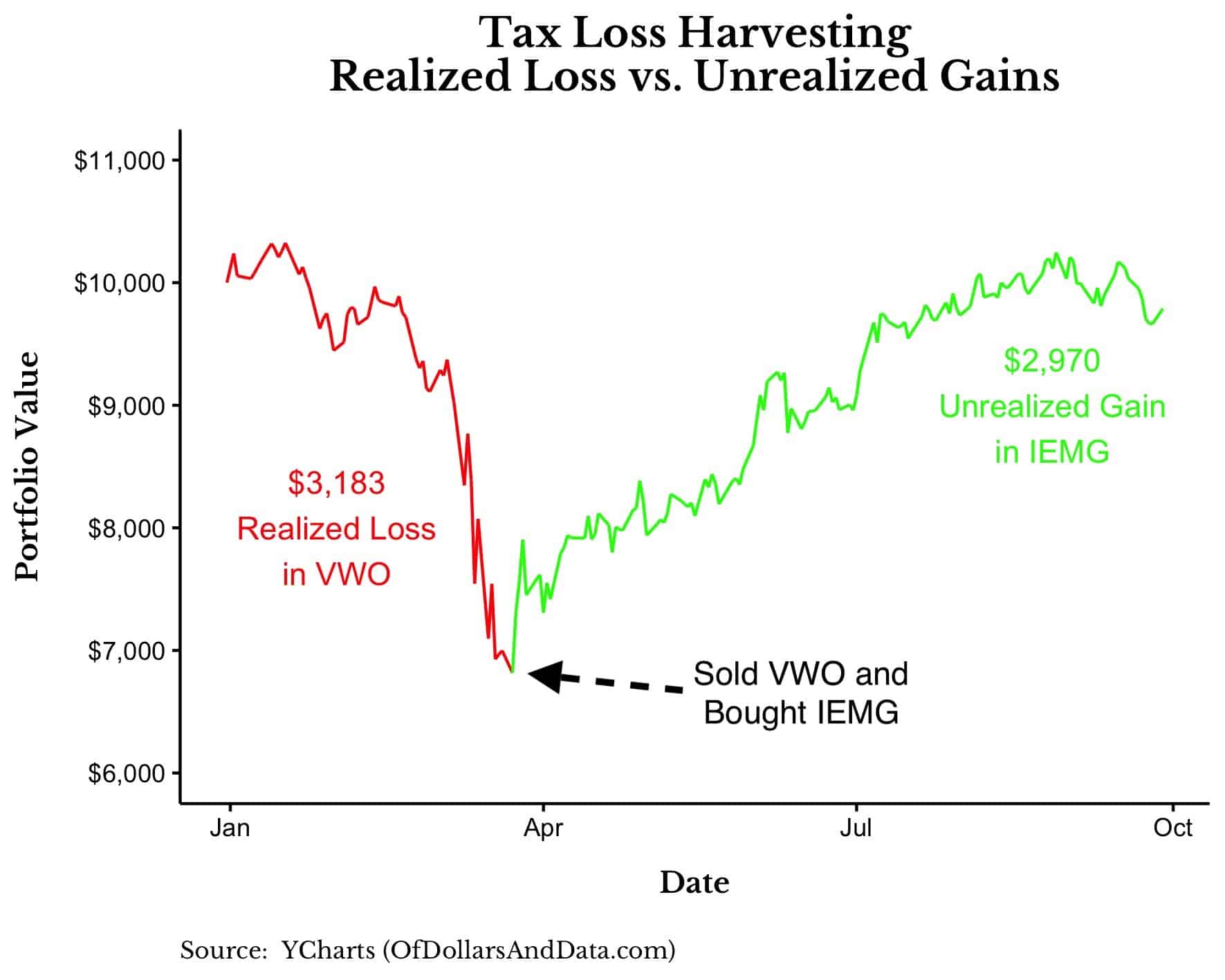

Tax Loss Harvesting ETF Example.

. However lets look at the. Tax-loss harvesting with ETFs is great already but conducting tax-loss harvesting using the stocks within an index gives you even more opportunities to harvest losses. Connect With a Fidelity Advisor Today.

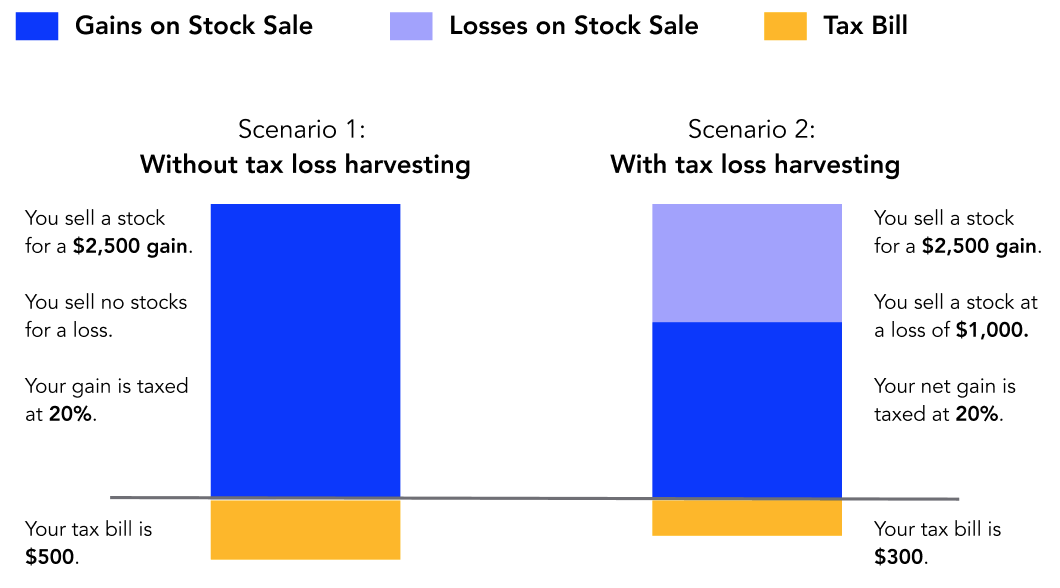

Assuming a long-term capital gains tax rate of 20 your tax bill is reduced from 6000 to. Learn How to Harvest Losses to Help Reduce Taxes. You could then apply the.

Ad Make Tax-Smart Investing Part of Your Tax Planning. Ad Browse Discover Thousands of Law Book Titles for Less. Tax loss harvesting example.

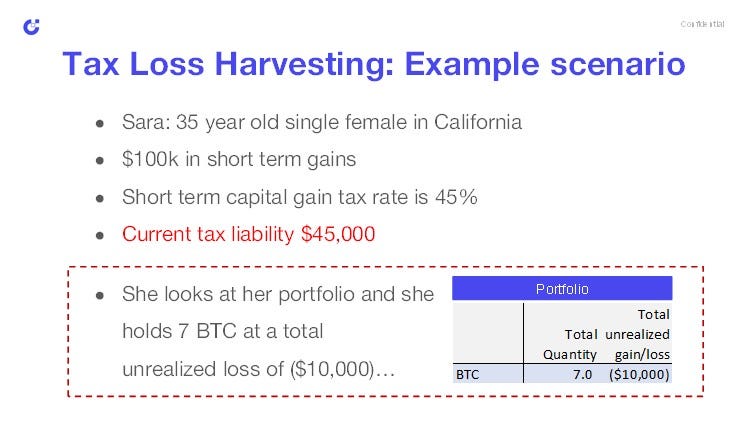

If you sold an investment property youd owned for less than 12 months and realized a profit that profit would be subject to short-term capital gains tax. Jessica purchases one BTC for 19000 holds it for three months and sells it for 21000. Heres a standard example of tax loss harvesting.

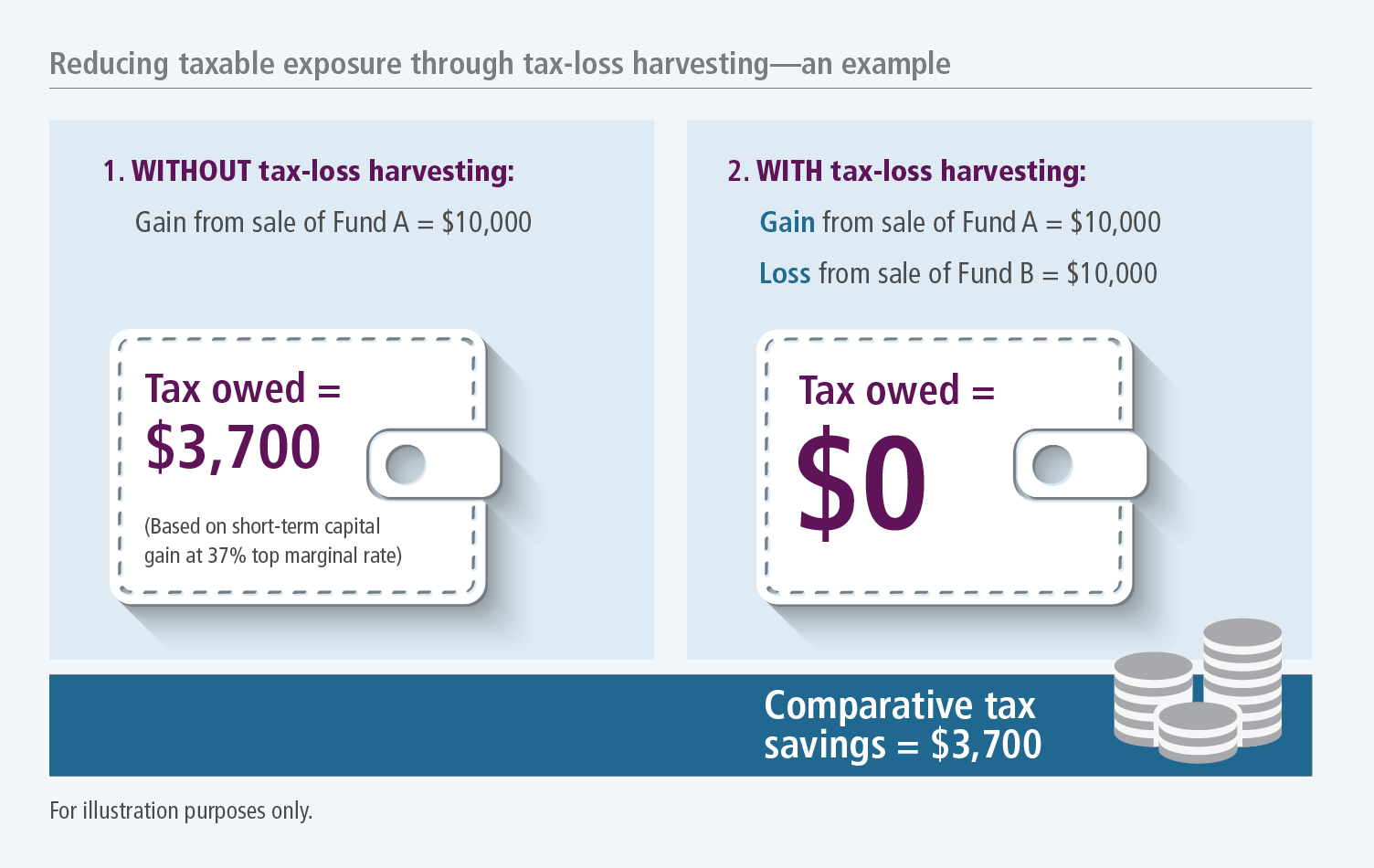

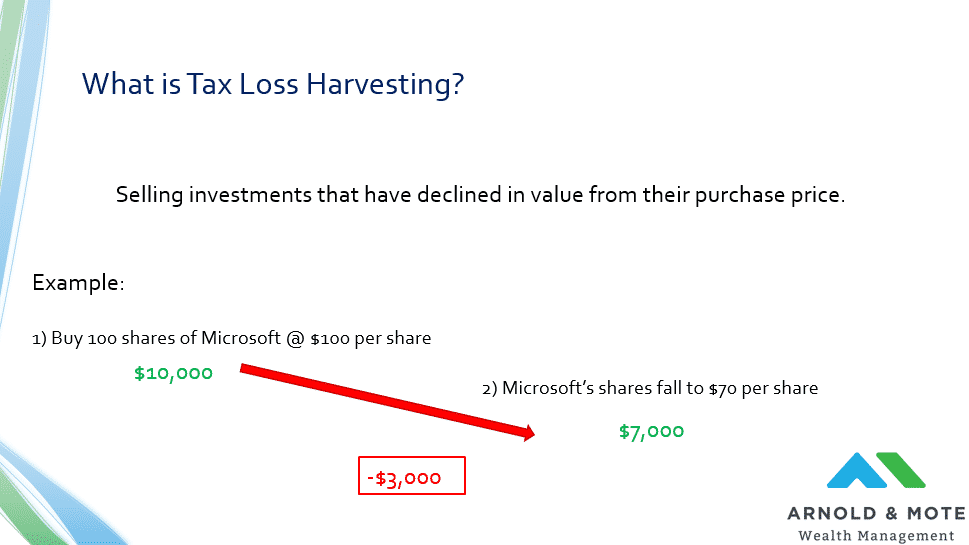

Help your clients reduce tax risk while maintaining market exposure. Tax-loss harvesting is the practice of selling an investment for a loss. Connect With a Fidelity Advisor Today.

You invested 25000 in the BMO SP TSX Capped Composite Index ETF ZCN in 2019 but. Ill use the following example to explain how tax-loss harvesting might work inside an ETF portfolio not actual returns for illustration only. Lets say Peter buys 100 shares of a utility stock call it stock ABC at 10 per share or 1000 invested.

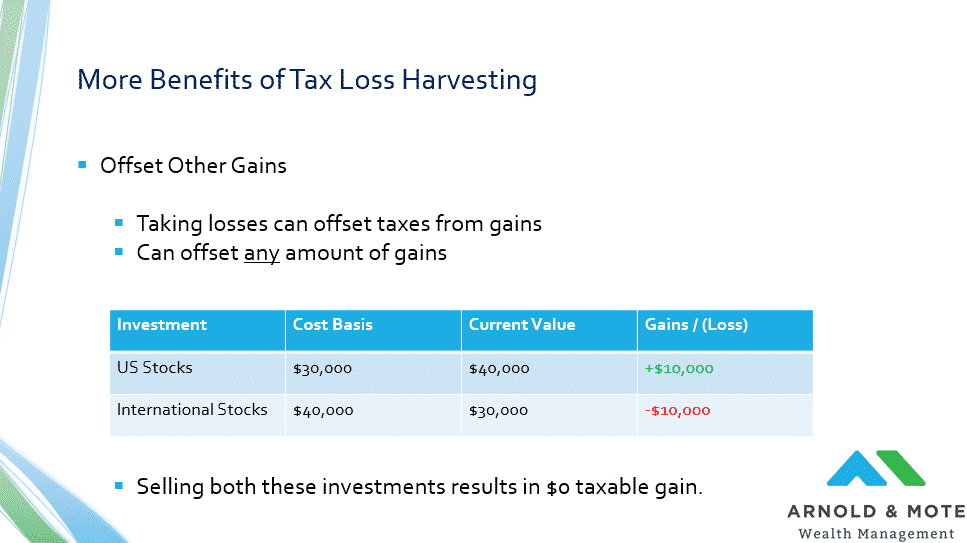

In addition if you have more losses than you do gains you can take up to 3000 and thats the maximum of those losses and use those to offset other ordinary income. While not always possible tax-aware investing should be a priority to receive more favorable tax treatment and enhance. In that same year Jessica buys 1 ETH for 1330 holds it for four.

You could offset some of that tax liability by selling your Acme Corp. Ad Make Tax-Smart Investing Part of Your Tax Planning. Income from your job a W.

Tax loss harvesting example. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. In this case she made a short-term capital gain of 2000.

Tax-loss harvesting can be useful in an array of situations but understanding when to best utilize this strategy is key. Lets move on to how to tax-loss harvest by using a tax-loss harvesting example. After a few months stock ABC falls to 6 per share.

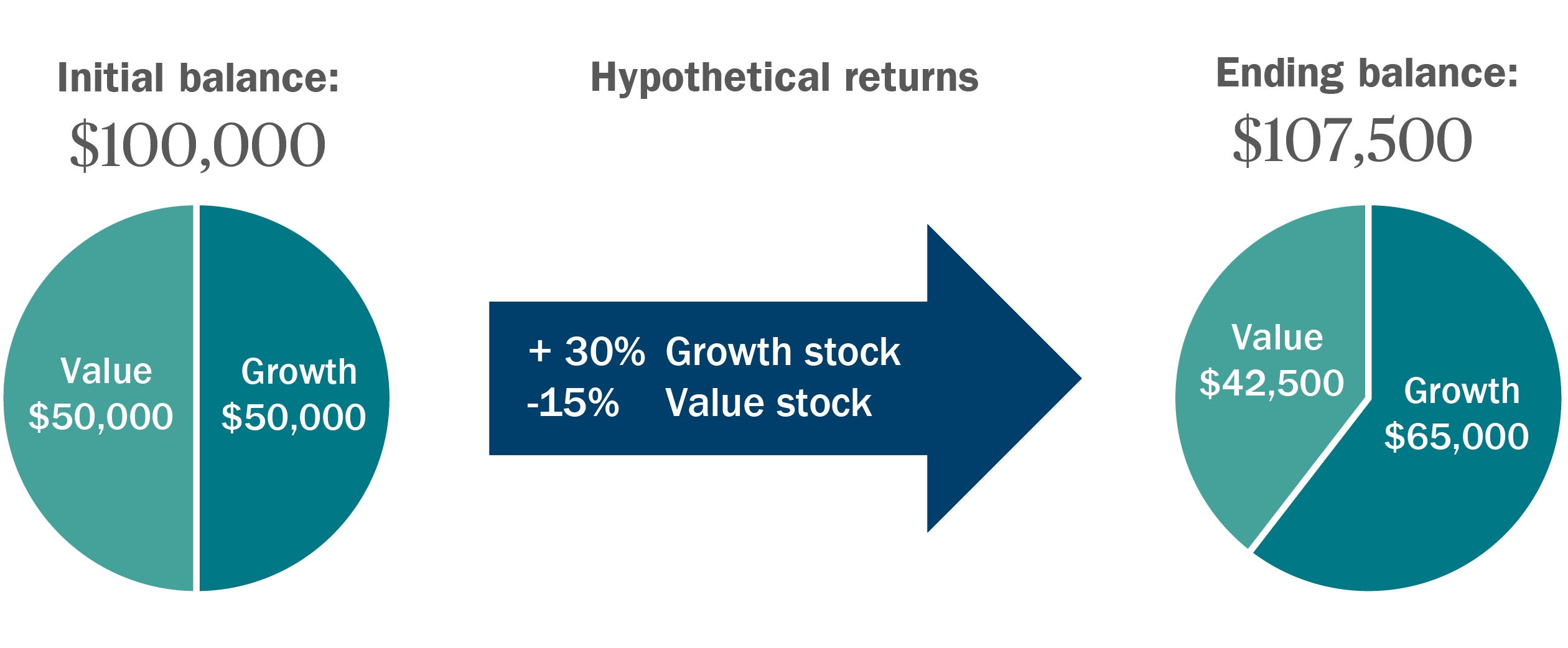

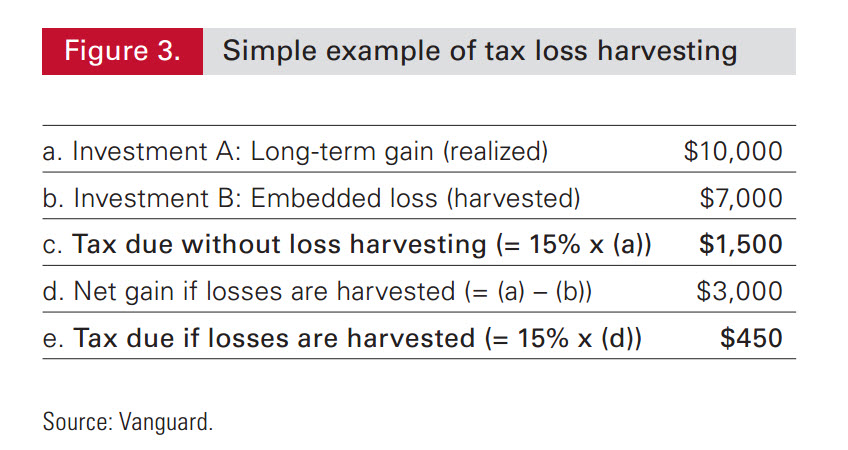

Lets look at a simplified. Elect to sell Investment B which generates a 15000 long-term loss. Parametric offers easy-to-understand transition analyses.

Because of tax loss harvesting your gain and loss offset each other to generate a net long-term gain of 15000. Suppose you bought 2 Bitcoins for 5000 and 5 Ethereum for 9000 in 2019. Identify Tax Loss Harvesting Ideas To Help Your Clients Keep More Of What They Earn.

Ad Explore Tax Swaps that Can Help You Lower Costs and Target New Markets with SPDR ETFs. Wealthfront is the only robo-advisor that offers both to everyday investors. Two years later you sell the 2 BTC for 8000 realizing a capital gain of 3000.

Because you lost 5000 more than you gained 25000 20000 you can reduce your ordinary income by 3000 potentially lowering your tax liability an additional 1050 3000 35 for a total savings of 8050 7000 1050. Investors can use a tax-loss harvesting calculator to assist them with determining how much is owed in taxes in relation to their gains. At the same time the 5 ETH you bought has now depreciated.

Ad Upload Your Portfolio In Tax Evaluator And See Funds To Tax-Loss Harvest. Example of a Crypto Tax Loss Harvesting Scenario. This example shows that the higher the tax rate the more critical tax-aware investing becomes and that ending wealth can be enhanced through tax-loss harvesting.

Tax Loss Harvesting Capital Loss Deduction Td Ameritrade

Tax Loss Harvesting Strategies How They Work

Your Guide To Tax Loss Harvesting Season By Reconcile

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

The 3 Ways Tax Loss Harvesting Can Save You Money Of Dollars And Data

What You Need To Know About Tax Loss Harvesting Ameriprise Financial Justin Samples Ameriprise Financial

Tax Loss Harvesting How To Get Part Of The Money You Lost In Crypto Back From The Irs By Alex Miles Tokentax Medium

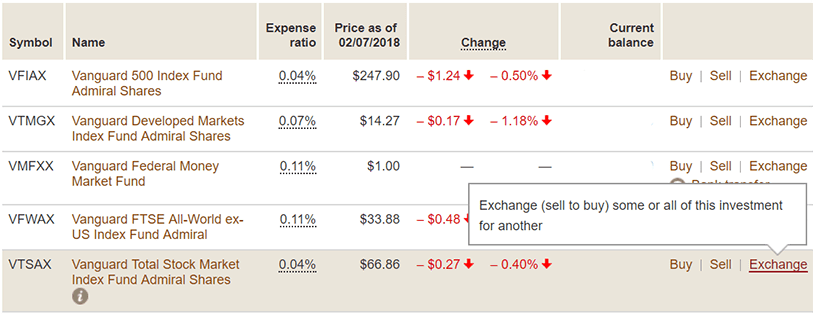

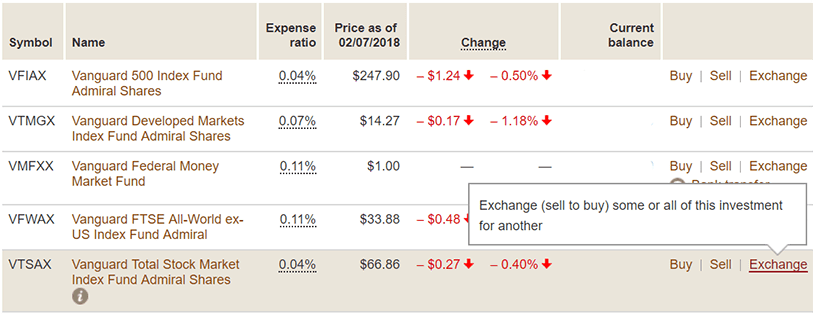

How To Tax Loss Harvest At Vanguard With Screenshots White Coat Investor

Tax Loss Harvesting Everything You Should Know

How To Make Your Investments Less Taxing

Tax Loss Harvesting Napkin Finance

Tax Loss Harvesting With Vanguard A Step By Step Guide Physician On Fire

Tax Loss Harvesting Year End 2018 John Hancock Investment Mgmt

What Is Tax Loss Harvesting Ticker Tape

Reduce Taxes With Tax Loss Harvesting

Playing The Long Game With Your Clients Tax Strategy Thinkadvisor

Reduce Taxes With Tax Loss Harvesting

.jpg)

The Ultimate Guide To Cryptocurrency Tax Loss Harvesting Coinledger