closed end credit account

A closed-end fund is not a traditional mutual fund that is closed to new investors. If your creditor reports your late payments your score will drop.

Using A Home Equity Loan For Debt Consolidation

A closed account is any account that has been deactivated or otherwise terminated either by the customer custodian or counterparty.

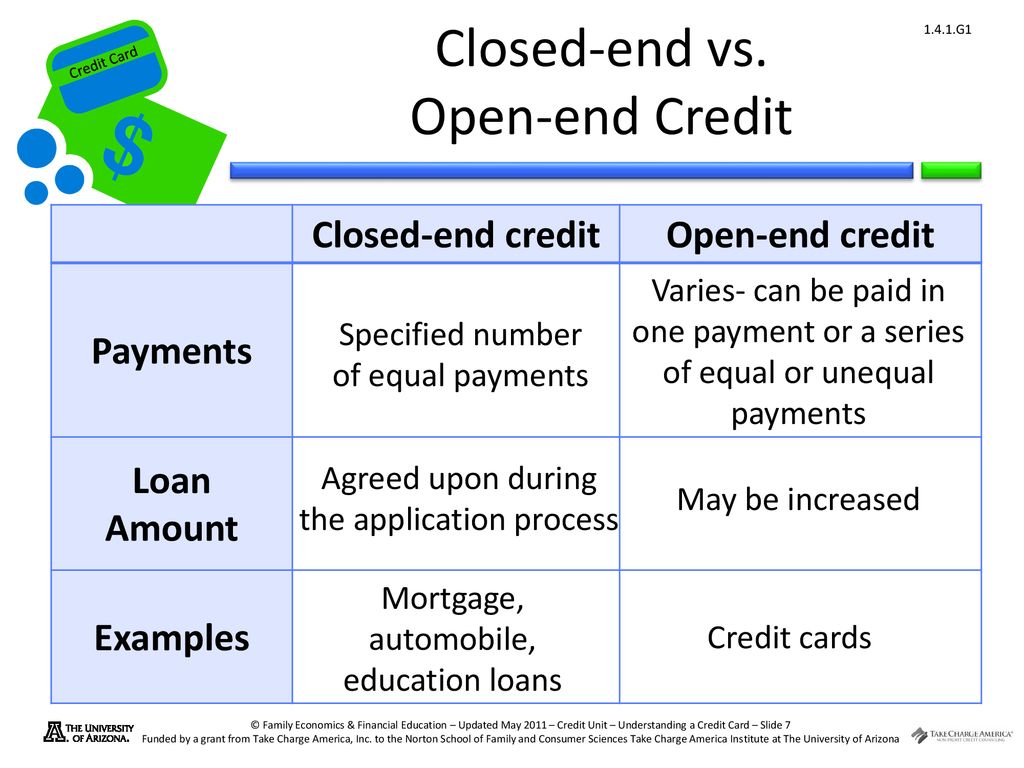

. Closed-end credit is any nonrevolving consumer lending product that provides borrowers with funding and a predetermined repayment schedule. The Uniform Retail Credit Classification and Account Management Policy establishes standards for the classification and treatment of retail credit in financial institutions. On the flip side.

Closed-end credit such as an installment loan or auto loan gives you a specific amount of money for a set time period. Examples of closed-end credit include personal loans auto loans mortgages. Closed-end credit is a one-time installment loan you usually take out for a specific purpose.

This form of credit features. Closed-end credit is an extension of credit that must be repaid in full by a specified date. You make monthly payments that include the loans principal balance and interest.

Closed-end credit is a type of credit that should be repaid in full amount by the end of the term by a specified date. Closed-end credit affects your credit score the same way as other credit accounts. The repayment includes all the interests and financial charges agreed at.

At its most fundamental level a CEF is an investment structure not an asset class organized under the. The term is often applied to a. In a closed-end consumer credit transaction secured by a first lien on real property or a dwelling other than a reverse mortgage subject to 102633 for which an escrow account was.

Closed accounts stay on your report for different amounts of time depending on whether they had positive or negative history. The choice of which type of credit to use will ultimately come down to why you. An account that was in good standing with a.

Reopening a closed account is a fairly straightforward process. This payment includes interest and principal which slowly decreases. Both forms of debt have their advantages and drawbacks.

Closed-end credit is a type of loan that you only take out once such as an installment loan. By goinfor800 May 19 2005 in Banking and Finance. Not every credit card issuer allows it but if it does it will typically require you to make the request within 30.

With closed end credit you agree to a monthly payment that youll make until the end of the loan term. Closed-End Account vs. After you repay your balance you cant use the credit or loan again.

The individual or corporation must pay the full loan including. Closed-end credit refers to financial instruments purchased for a specific purpose and for a specified period of time. Open-Ended Account - Banking and Finance - Credit InfoCenter Forums.

:max_bytes(150000):strip_icc()/GettyImages-1226911217-72cfba72d793417dae710d72baa38ca6.jpg)

Closed End Line Of Credit Definition

Understanding A Credit Card Ppt Download

Credit Basics Vocabulary Flashcards Quizlet

What Is Closed End Credit Experian

Before You Take On Debt Discover What S Best

Closed End Credit Awesomefintech Blog

Understanding Open End Credit Youtube

How Closing A Credit Card Account For Inactivity Will Affect Your Score

:max_bytes(150000):strip_icc()/GettyImages-707452833-5ae73fce43a1030036ceb1d6.jpg)

How Closed End Credit Is Paid Off

Credit Basics Advanced Level Pdf Free Download

Opensesame Elearning Marketplace

What Is Closed End Credit Cash 1 Blog News

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Vplc Supports Legislation Regulating Line Of Credit And Open End Credit Lenders Virginia Poverty Law Center Virginia Poverty Law Center

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Fillable Online Loanliner Open End Plan Credit Agreement Form Fax Email Print Pdffiller

:max_bytes(150000):strip_icc()/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

Understanding Closed End Credit Vs An Open Line Of Credit